Our Features

What You Actually Get (That No Software Can Offer)

1-on-1 Expert Accounting Analysis

Talk to a real accountant – not a chatbot. We review everything with you and make sure it’s done right.

From Report to Filing – Done for You

No CSV uploads. No syncing issues. We handle every step from tax report creation to final filing.

A Human Partner Through Every Step

You’ll never wonder what to do next. We walk with you from start to finish – with no gaps, no guesswork.

How it works

How It Works — End-to-End, With a Human Touch

Submit Your Inquiry

We’ll respond within 24 hours to confirm next steps and get you started.

Book Your Free Consultation

One-on-one call with a crypto tax expert — no templates, no fluff.

Send Docs & Clarify Questions

Upload wallet data, exchange summaries, or anything else we request

Review Your Crypto Report & Tax Return

We deliver clean, audit-ready documents. You’ll know exactly what’s filed and why.

Plan Ahead — Tax Strategy Included

We offer future focused sessions on tax planning and wealth management.

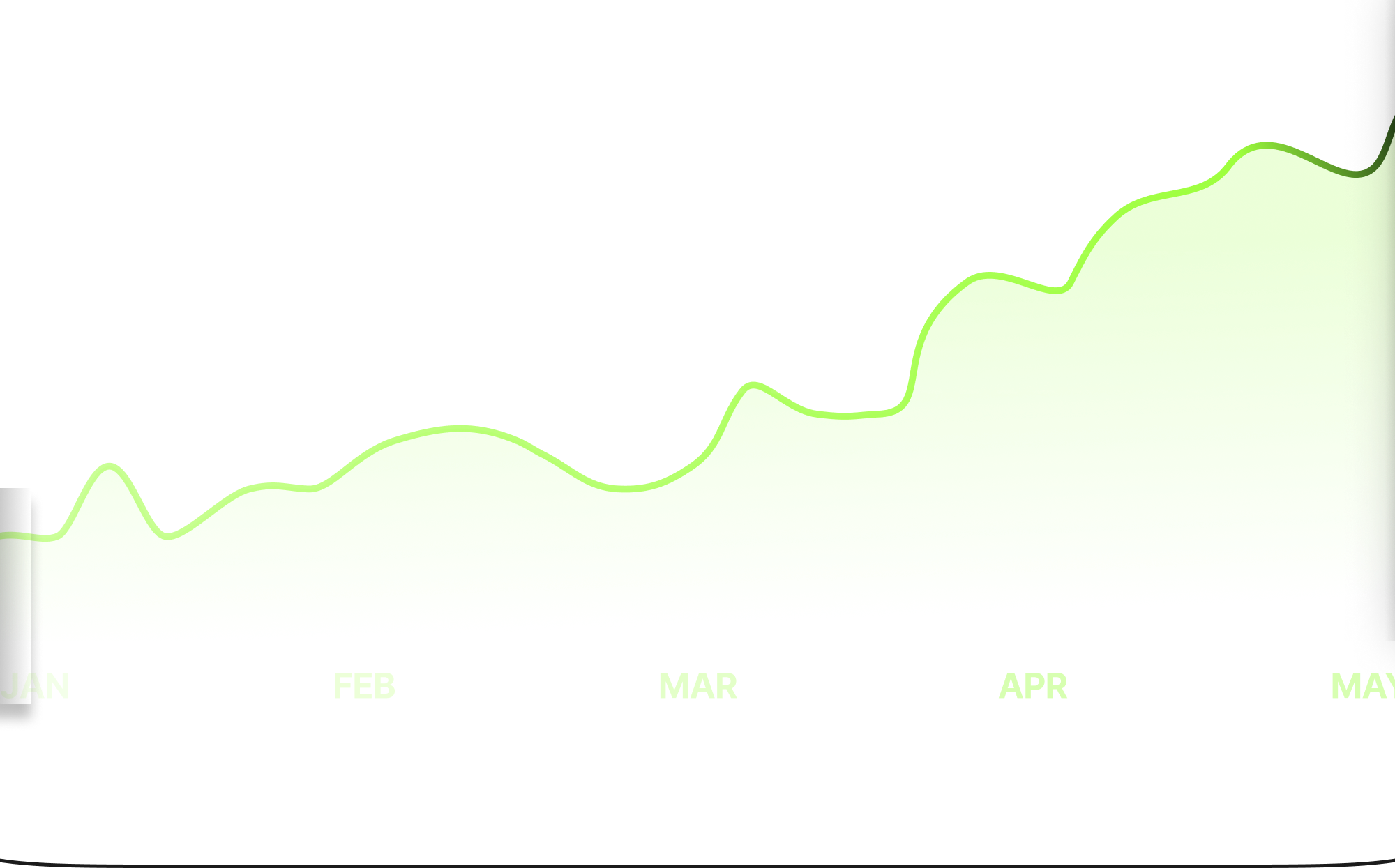

Full-Service Crypto Accounting

Done For You by Real Experts

From crypto tax reports to tax planning, onshore/offshore structuring, and fiat on/off-ramp services

– we handle

everything. No DIY tools. Just real accountants and bulletproof compliance.

Block3 Finance

Experts of every exchange, no exceptions

We work with all these wallets and exchanges, we are comfortable with them, and

none of them are challenging to us.

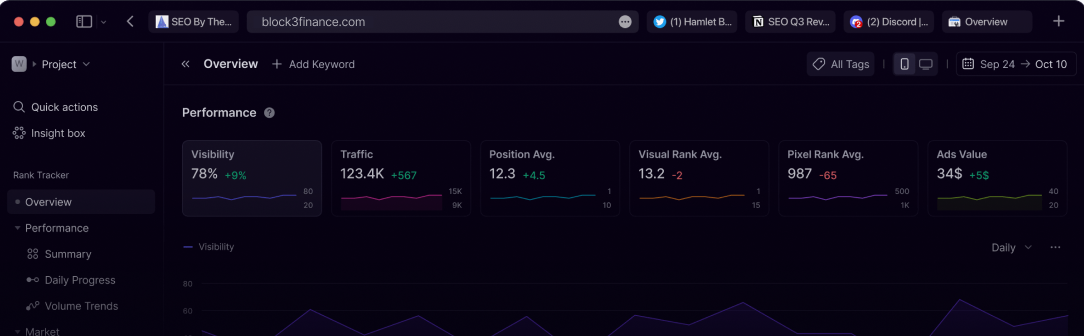

Comparisons

How It Works — End-to-End, With a Human Touch

- Feature

- Real human support

- Handles DeFi, NFTs, DAOs

- End-to-end tax filing

- Onboarding walkthrough

- Audit Support

- Tax Strategy

- Global Compliance

- Accuracy

- Pricing Transparency

- Full Service

- Block3 Finance

Real accountants

Real accountants

Experts in all

aspects of Crypto

Experts in all

aspects of Crypto From start to

finish

From start to

finish One-on-one support

One-on-one support

Comprehensive Audit

Support

Comprehensive Audit

Support Tax Strategy

Session included

Tax Strategy

Session included Every country

globally

Every country

globally Reconciled by

Accountant

Reconciled by

Accountant Fixed no surprises

Fixed no surprises

Done-for-you

Done-for-you

- Crypto Softwares

Ticket/chat only

Ticket/chat only

Limited support

Limited support Exports only

Exports only DIY, often confusing

DIY, often confusing

None

None Not offered

Not offered Mostly local

Mostly local Auto-generated only

Auto-generated only

Add-ons/tiered

Add-ons/tiered Manual CSV work

Manual CSV work

FAQs

Frequently Asked Question

We handle your entire crypto tax lifecycle - from wallet & exchange data collection, to preparing your crypto tax report, to filing it with the CRA, IRS, or your local authority. We assist with tax strategy, entity structuring, and audit representation is included with your return.. From your first wallet to your final return - we're with you at every step.

Those platforms only generate reports - you're still left to file and fix issues yourself. With Block3, real crypto accountants handle everything for you. No CSV uploads, syncing errors, or audit risks. We ensure accurate, audit-ready filings - done right the first time.

Yes. High volume, high-complexity cases are our specialty. Whether you're using MetaMask, Curve, OpenSea, or dozens of wallets - we'll reconcile it all and deliver a clean, compliant tax package. We support all types of transactions including trades, transfers, and wallet interactions across all blockchain networks and DeFi platforms.

We offer historical cleanup from your first transaction in crypto and tax return adjustments if necessary. Our team reviews past filings, identifies errors, and corrects them - protecting you from penalties, audits, or overpayments.

Yes. It doesn't matter if you only made losses, you still have to report them to your tax agency. It is in your best interest to report your losses as this is one of the best ways to reduce future crypto taxes

You get a dedicated crypto accountant. No chatbots, no tickets - just expert, one-on-one guidance tailored to your situation. We're real people and we're here to help.

We file your taxes for you, no matter where you're located. Most of our clients are based in Canada and the U.S., we also support clients globally. Whether it's CRA, IRS, or another tax authority - we prepare and file your returns with full compliance.

Once we receive your documents, we typically turn around your full tax package within 5–10 business days - faster for standard files.

Pricing depends on your transaction volume and needs. Every client begins with a free 30-minute consultation, and you'll receive clear guidance and transparency on our fees - no surprises.

Yes we offer strategic tax planning for crypto. Whether you need help with incorporation, deferrals, founder vesting, or token launches, we'll guide you on reducing tax and staying compliant.

Absolutely. We use encrypted storage, follow strict compliance protocols, and never outsource your data. Your privacy and security are top priority.

No problem! You can speak directly with a crypto accountant. Book your free initial consultation and find out why traders around the world trust Block3 Finance for their crypto tax and accounting needs.